What is Insurance Marketing?

Insurance marketing is the process of strategising the marketing of insurance products and services to their target audiences. The insurance industry deals with risk management and financial security. Hence it is pivotal to have effective marketing strategies as it can help the providers connect with potential clients. By utilising various marketing techniques, insurers can communicate their value proposition, build trust, and guide consumers towards making informed decisions about their insurance needs.

What is the Role of Marketing in the Insurance Industry?

Marketing strategy for an insurance company goes beyond simple advertisements. It’s about educating customers, establishing credibility, and fostering long-term relationships. The insurance sector is highly competitive, and the marketing of insurance services serves as a bridge between insurers and clients, offering tailored solutions that cater to specific needs. With the right marketing strategies, insurance companies can differentiate themselves, expand their reach, and drive growth.

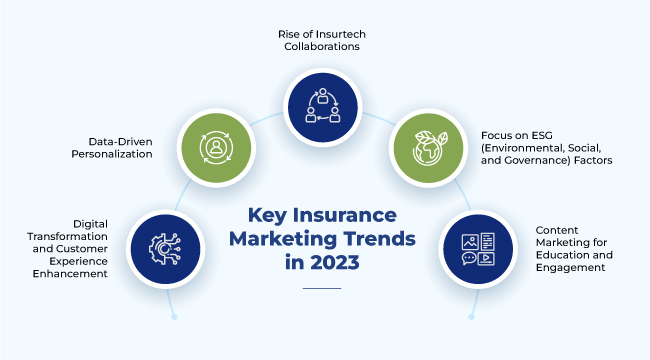

Key Insurance Marketing Trends in 2023

-

Digital Transformation and Customer Experience Enhancement

Insurance digital marketing is on the rise as companies are increasingly investing in digital tools and platforms to enhance customer experiences. The integration of AI-driven chatbots, mobile apps for claims processing, and personalised online portals streamline customer interactions and improve satisfaction.

-

Data-Driven Personalization

Insurers are leveraging data analytics to personalise their offerings and communication strategies. By analysing customer data, insurers can create tailored policies, suggest relevant add-ons, and send personalised messages, enhancing customer engagement and loyalty.

-

Rise of Insurtech Collaborations

Partnerships between traditional insurers and insurtech startups are on the rise. Insurtech collaborations bring innovative technologies such as blockchain, telematics, and wearables into insurance products, improving risk assessment accuracy and speeding up claims processing.

-

Focus on ESG (Environmental, Social, and Governance) Factors

Insurers are incorporating ESG considerations into their marketing and product offerings. Customers are increasingly concerned about sustainability and social responsibility. Insurance companies are aligning their strategies with these values, offering ESG-focused products and showcasing their commitment to responsible business practices.

-

Content Marketing for Education and Engagement

Insurance companies are utilising content marketing to educate customers and build trust. Blogs, videos, and infographics that explain complex insurance concepts, offer risk management tips, and share customer stories create a sense of transparency and establish insurers as trusted advisors.

Five Trends that Will Affect the Future of Insurance Marketing

-

Customer-Centricity as the Core Strategy

Insurers are shifting their focus towards customer needs and preferences. Customer-centric marketing ensures that insurance products and services align with customer expectations, resulting in improved satisfaction and retention rates.

-

Integration of AI and Automation

Artificial Intelligence is being integrated into various marketing processes. AI assists in data analysis, chatbots for customer interactions, and predictive modelling for targeted marketing efforts, allowing insurers to deliver personalised experiences efficiently.

-

Omni-Channel Engagement

Insurers are utilising multiple channels to engage customers. From social media and mobile apps to traditional advertising, insurers are ensuring a seamless and consistent experience across various touchpoints.

-

Risk Prevention and Education

The insurance market is increasingly focusing on proactive risk prevention and education. By educating customers about potential risks and offering guidance on risk mitigation, insurers can position themselves as partners in safeguarding clients’ interests.

-

Leveraging Behavioral Economics

Insurance companies are applying behavioural economics principles to influence consumer decisions. Insurers are designing products and communications that align with psychological biases, making it easier for customers to understand their options and make informed choices.

Impactful Insurance Marketing Strategies

More than digital marketing is needed to succeed in insurance marketing in 2023 and beyond, as growth marketing is gaining traction and is much more suited to future-proof marketing strategies.

Re-design your website: The absolutely essential part of insurance marketing is a well-designed website that represents the company’s personality through logos & colour tones a is mobile-friendly.

Build an effective SEO strategy: An effective SEO strategy is required to get the website in front of people’s eyes; it can include creating relevant, easy-to-read content using keywords and making the website easy to navigate.

Create a Social Media presence: Building a social media presence is also a helpful way for a business to reach its target audience by posting constantly engaging content on social media sites tailored to the intended audience.

Leverage customer reviews: Showcasing what your happy customers say about you can help build trust among the new clientele.

Run PPC (Pay-Per-Click) campaigns: Organic marketing can only go so far. It needs a targeted PPC campaign to boost a business’s reach as it connects the business directly with potential clients and is much more likely to produce tangible results.

Use e-mail marketing: E-mail marketing is a very helpful tool for a business to convert new leads into customers or to retain existing customers and build a long-lasting relationship wi

Conclusion

In the dynamic landscape of insurance marketing, be it general insurance or life insurance marketing, staying ahead requires embracing technology, understanding customer needs, and adapting to evolving industry trends. From personalisation and data-driven insights to strategic collaborations and ESG considerations, insurers are leveraging innovative strategies to create meaningful connections with their audience. By implementing these trends and strategies, insurance companies can navigate the evolving market landscape, build lasting relationships, and drive sustained growth in 2023 and beyond.

Amura Marketing Technologies is a leading insurance marketing company with over 15 years of experience in the market, providing growth marketing services like website development, paid marketing, SEO and SEM optimisations, content writing, lead generation and more. Our meticulously designed strategies are catered to your unique business goals and can help you scale your business successfully.